Federal Pay Period Calendar 2023: Explained in Simple Terms

Are you a federal employee wondering about the 2023 pay periods? This article will break down everything you need to know in a clear and concise way.

Think of it as a roadmap for your paychecks throughout the year. It outlines the specific dates for each pay period, ensuring you know when to expect your hard-earned cash.

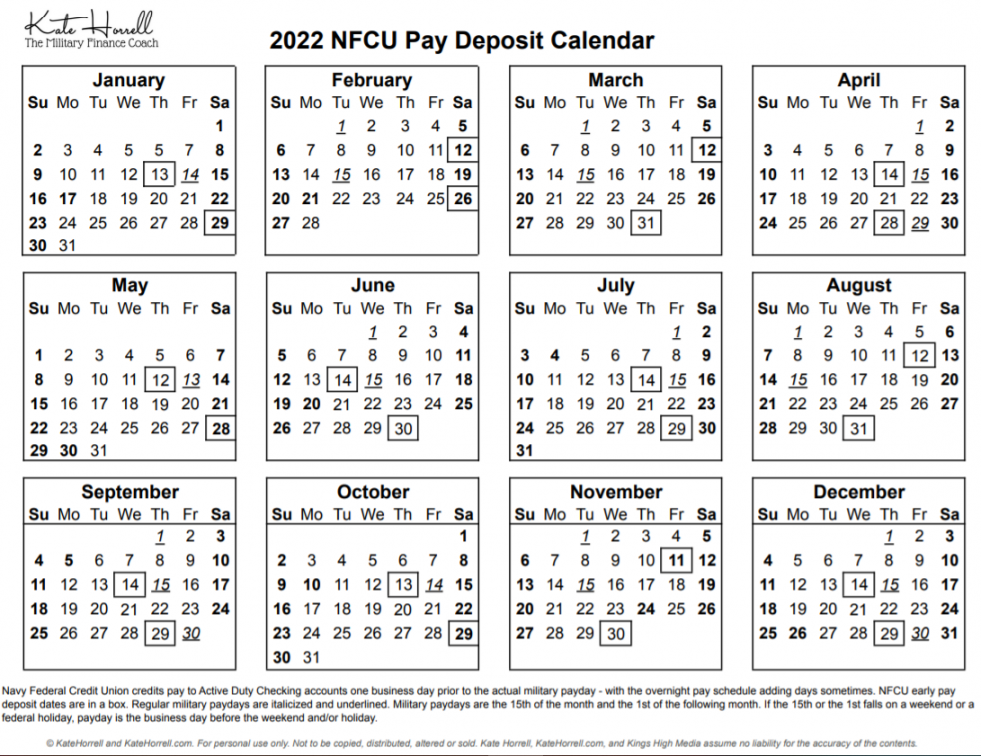

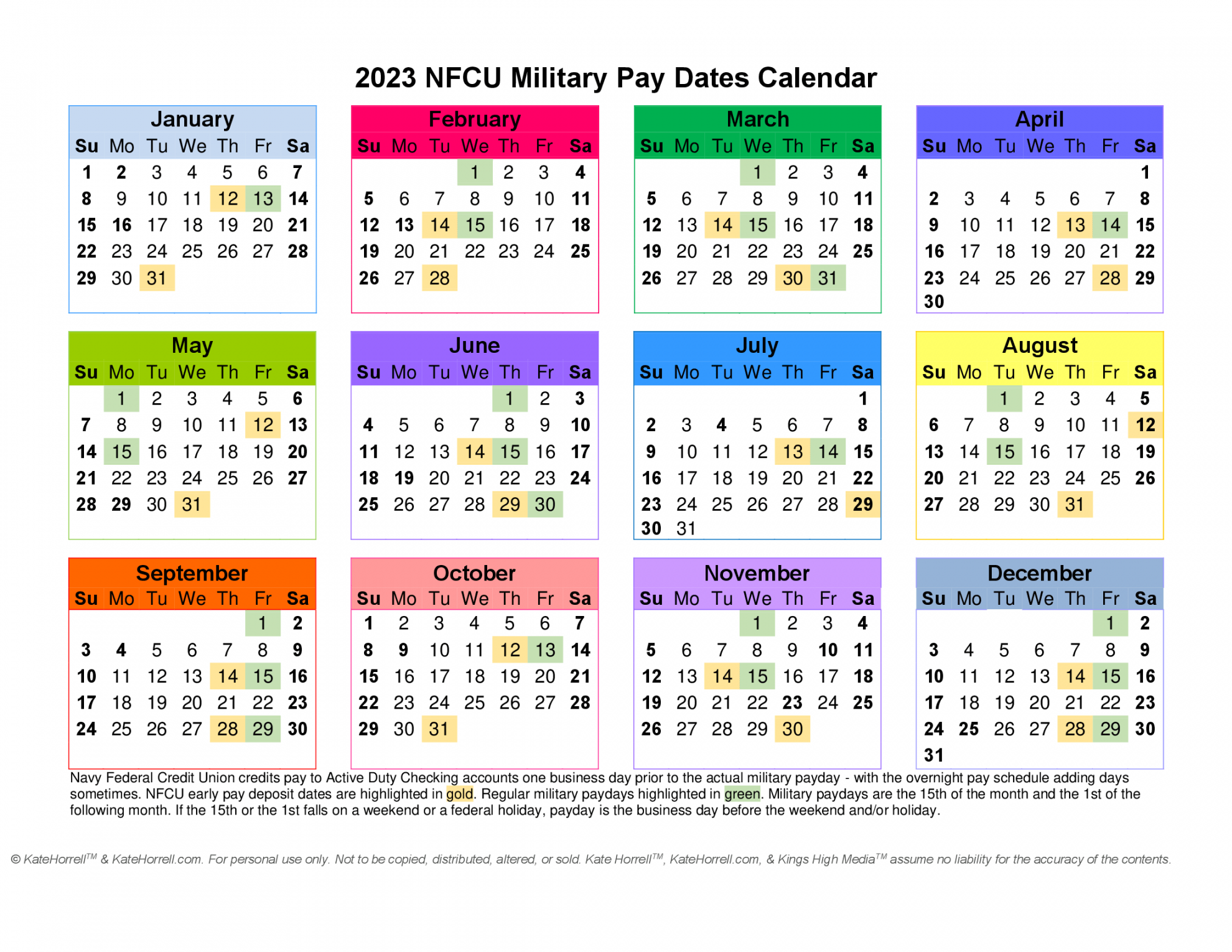

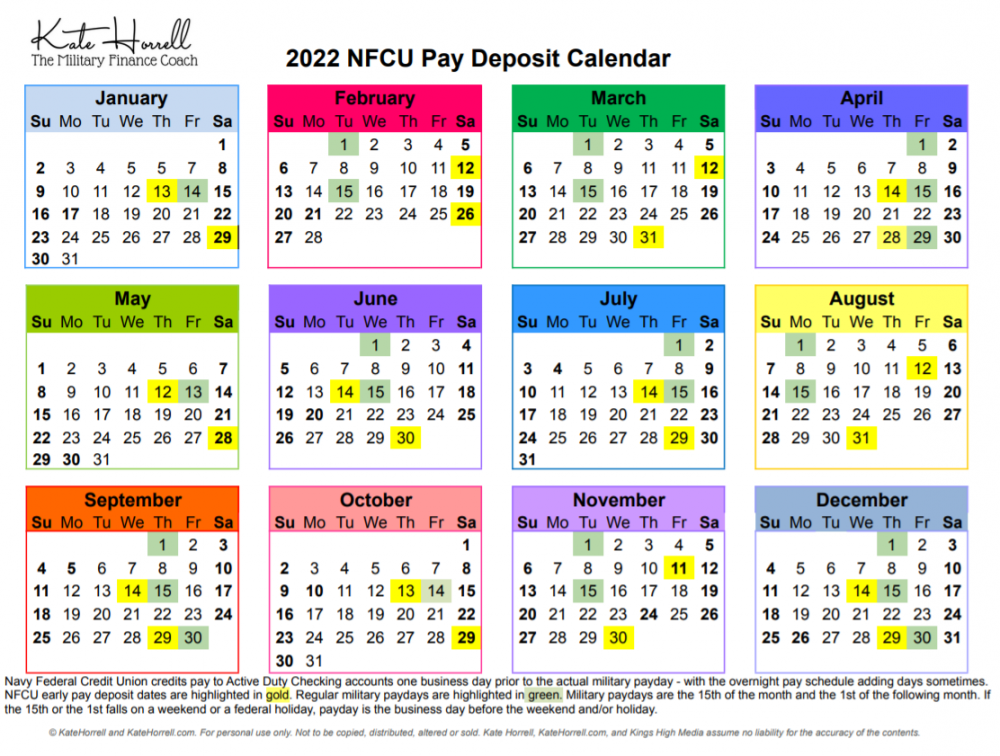

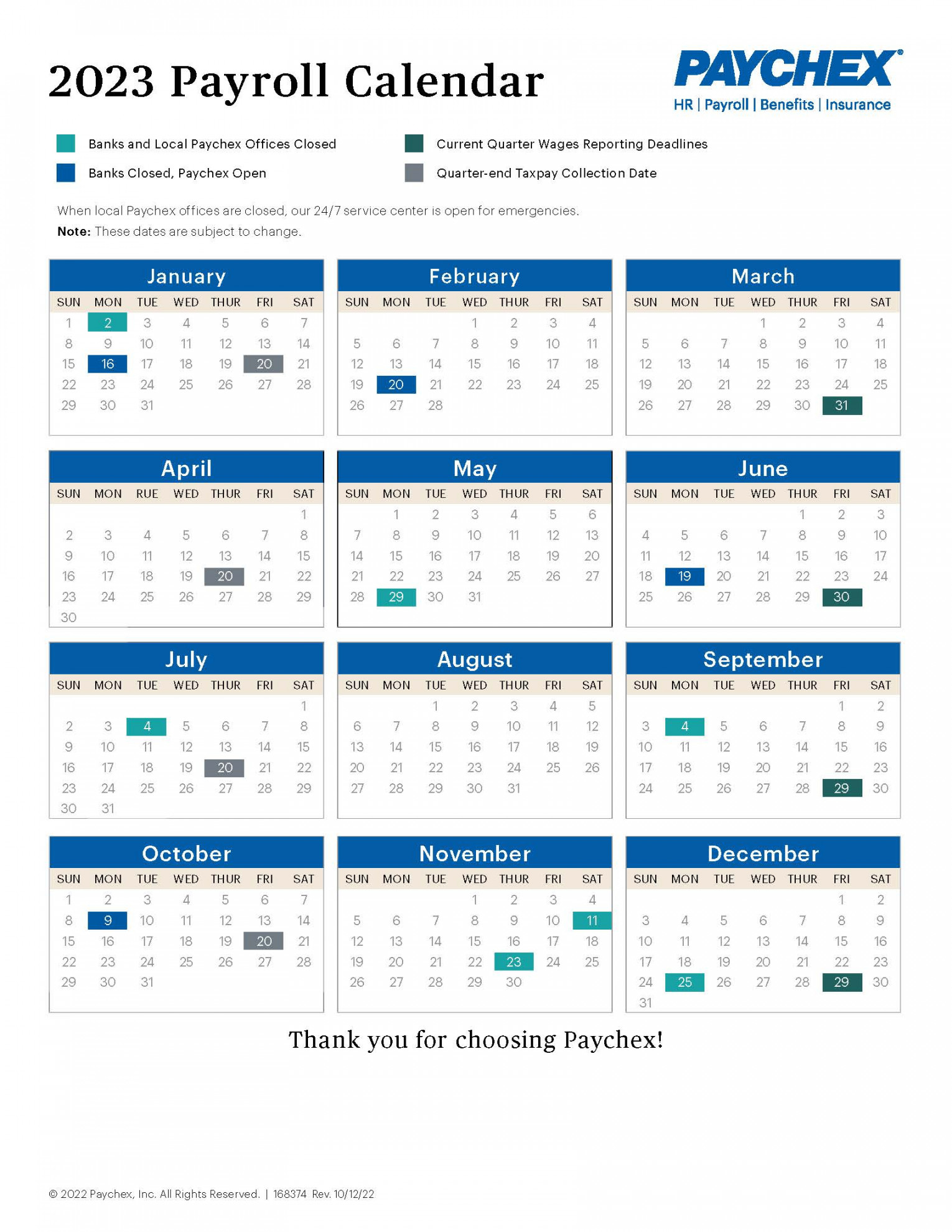

The federal fiscal year runs from October 1st to September 30th. There are 26 pay periods within this timeframe, divided into two-week biweekly periods. Each period is assigned a unique number, starting with PP1 in early October and ending with PP26 in late September.

Besides the pay period numbers and their corresponding dates, the calendar may also include information like:

Pay dates: When you can expect your paycheck to be deposited.

Having a clear understanding of the calendar offers several benefits:

Budgeting: You can plan your finances effectively, knowing exactly when your income will arrive.

There are several official sources where you can access the calendar:

National Finance Center: [https://www.nfc.usda.gov/ppcalendar/](https://www.nfc.usda.gov/ppcalendar/)

Pay periods can vary slightly depending on your agency. It’s crucial to confirm the specific calendar applicable to your situation.

Understanding the federal pay period calendar is vital for any federal employee. By knowing when to expect your paycheck and other important deadlines, you can manage your finances effectively and plan your schedule accordingly.

1. What happens if I miss a pay date?

Contact your agency’s payroll office immediately. They can investigate the issue and ensure you receive your paycheck as soon as possible.

2. Can I change my pay period?

This depends on your agency’s policies. In some cases, you may be able to request a change, but it’s not guaranteed.

3. What happens if I have a question about the pay period calendar?

Contact your agency’s HR department. They are trained to answer your questions and provide guidance.

4. How can I stay updated on any changes to the calendar?

Subscribe to your agency’s HR communications or check their website regularly for announcements.

5. Where can I find information about my specific pay period details?

Log in to your employee portal or contact your agency’s payroll office for personalized information about your pay dates and deductions.