Experts: 9 Best Ways To Invest the Extra Money During Three-Paycheck Months

AndreyPopov / Getty Images/iStockphoto

If you’re paid on a bi-weekly pay schedule, did you know there are two months when you’ll receive three paychecks instead of two? While you might be tempted to go out and spend that extra money, there are better things you can do instead.

I Grew Up Poor: Here Are 8 Things I Never Waste Money OnLearn: How To Get Cash Back on Your Everyday Purchases

Within this article, we will start by helping you understand the difference between bi-weekly and bi-monthly pay schedules and then look at different ways you can use (or invest) your extra paychecks.

Bi-Weekly vs Bi-Monthly Paychecks

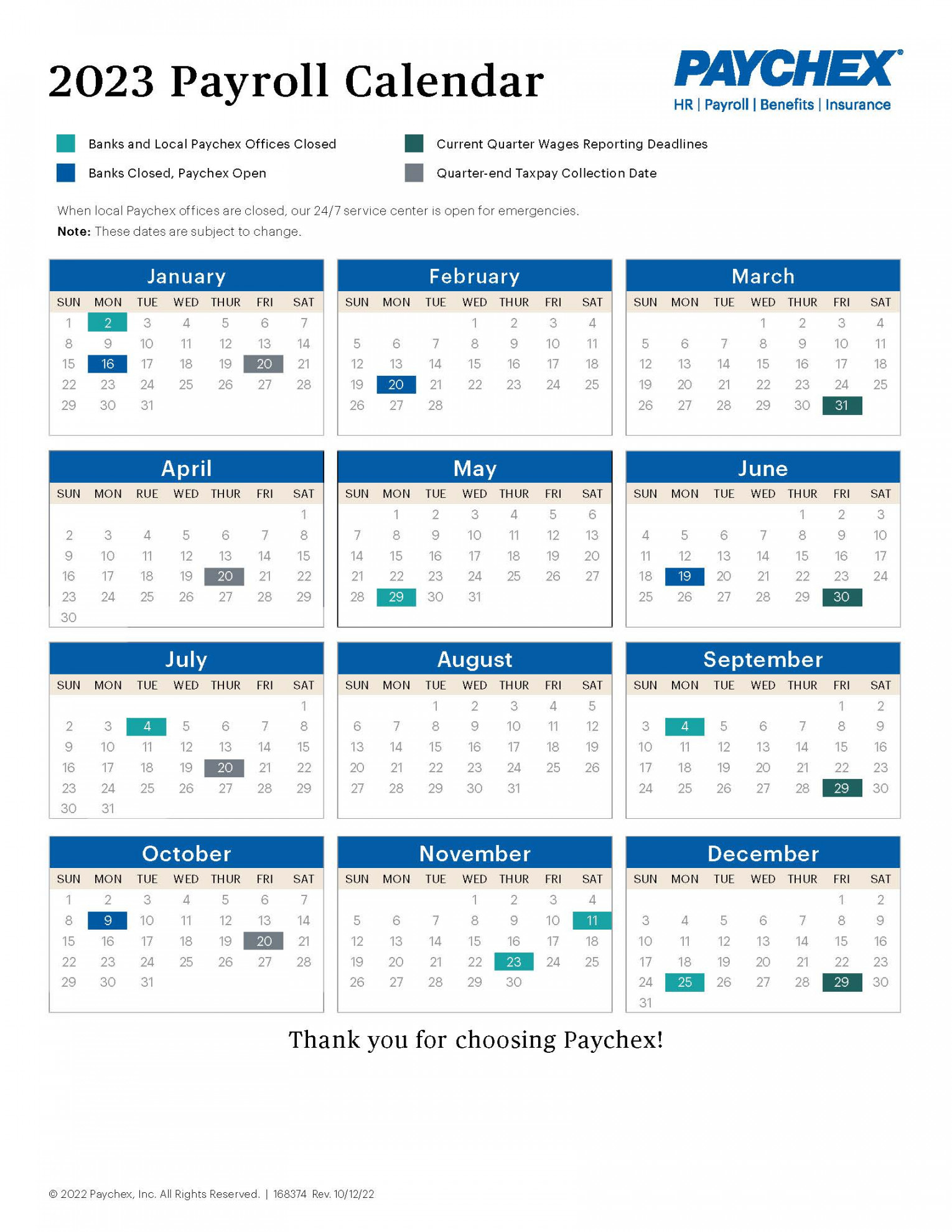

Most employers will follow one of two different pay schedules: bi-weekly or bi-monthly. Only bi-weekly pay schedules have the luxury of three paycheck months, so let’s explain both.

Bi-Weekly

Bi-weekly is the most common payment schedule for many employers. If this is how you’re paid, you’re getting a check on a specific day of the week, every other week. For most people, this happens to be on Fridays. With a bi-weekly pay schedule, you’ll receive 26 paychecks each year, and two months will include three paychecks.

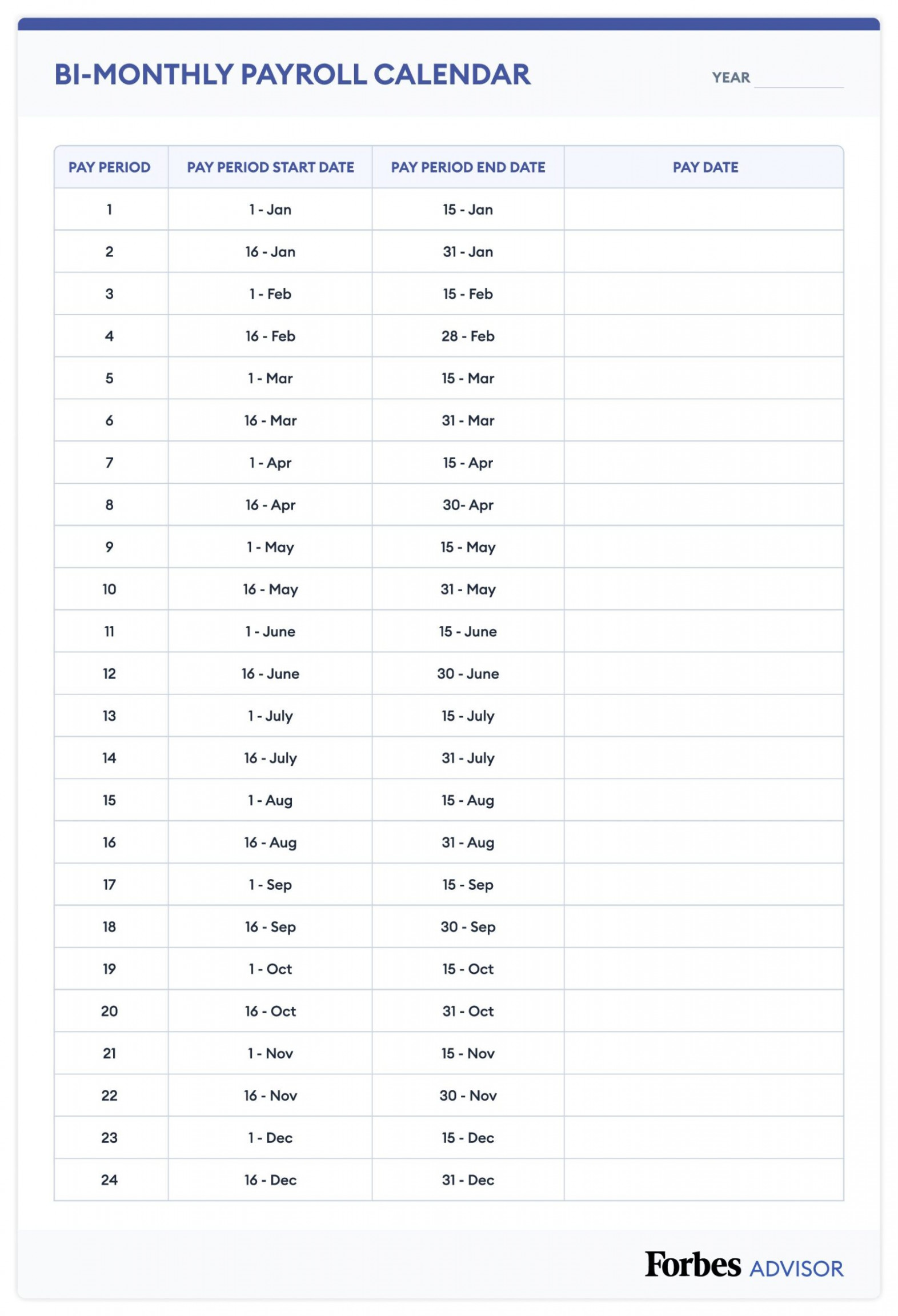

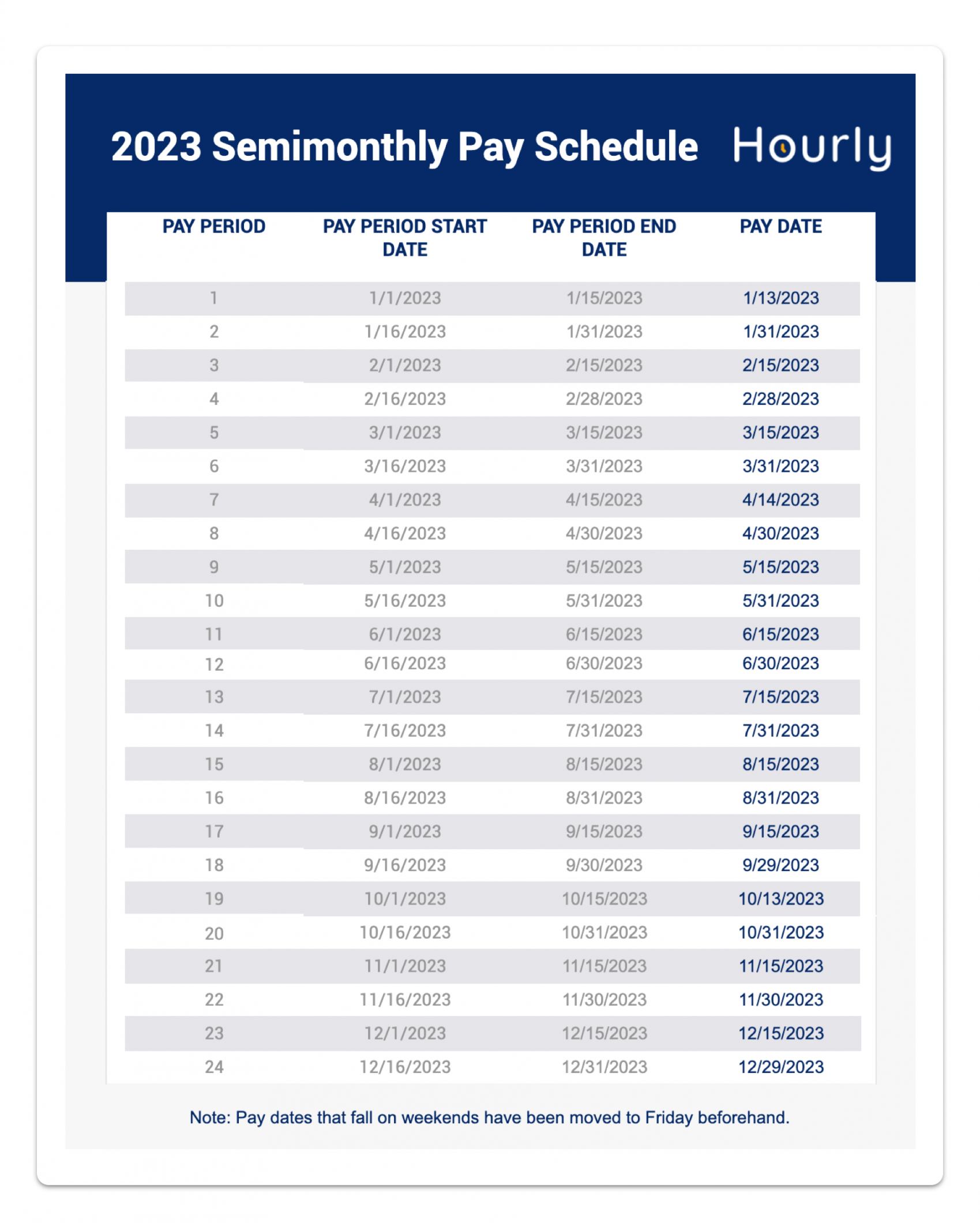

Bi-Monthly

Another typical pay schedule is bi-monthly. This is where you would get paid twice a month, typically 15 days apart. For many, it occurs on the 1st and 15th of the month. If you’re paid bi-monthly, each month would always include two paychecks. That means there would be no months with a surprise extra payday.

Three Paycheck Months in 2024

If you’re unsure which months you’ll receive three paychecks in 2024, here’s a guide to help you plan.

March and August – Your first paycheck in 2024 is on Friday, January 5

May and November – Your first paycheck in 2024 is on Friday, January 12

The ‘One Hour’ Savings Rule: David Bach Says It’s Only ‘Proven, Easy Way To Get Rich’

9 Best Ways to Invest Your Extra Paychecks1. Pay Off Debt

One of the best uses for your extra paycheck is to pay off any high-interest credit card debt you might have. Credit card debt can negatively impact your finances, making it hard to get ahead.

“If you have unsecured debt, such as credit card balances, prioritize those first, says Brian Davis, Real Estate Investor and Founder of SparkRental.com. “It doesn’t make sense to invest for 8-10% returns if you’re losing 16-25% on credit card balances.”

If you don’t have credit card debt but still have student loans to pay off, this is a great chance to cut down your balance a little faster.

2. Boost Your Emergency Fund

Having an emergency fund is one of the best things you can do for your finances. Unfortunately, a recent GoBankingRates.com survey found that 17% of Americans don’t even have a savings account. An emergency fund can help you cover unexpected expenses like a car repair or a broken water heater without going into debt.

Most financial experts recommend having between three and six months’ worth of expenses in your emergency fund. This will help cover any unexpected expenses that could pop up. It could also be used if someone in your family lost their job.

3. Start a “Cash Cushion” Emergency Fund

If you already have a sizeable balance in your regular emergency fund, consider using your extra paychecks to fund a “cash cushion” emergency fund to help you fund other opportunities.

“This fund is different from your regular emergency fund and acts as a financial buffer specifically for unexpected opportunities, says Skyler Fernandes, Founder and General Partner at VU Venture Partners. “By setting aside a portion of the extra income in this fund, you’ll have a financial safety net ready for unique investment opportunities, such as real estate deals or startup investments, that may arise when you least expect them.”

4. Make an Extra Mortgage Payment

While credit cards and other high-interest debt should be a priority, you might also aim to pay off your mortgage quickly. If so, you could use your extra paychecks toward your mortgage balance. Make sure the entire payment is allocated toward your principal balance, and this will help reduce the overall interest you’re paying.

5. Increase Your Retirement Contributions

In 2023, you can invest a maximum of $6,500 in an IRA ($7,500 for anyone over age 50) or $22,500 in a 401k ($30,000 if you’re over 50). If you’re not maximizing your retirement contributions, you could choose to invest your extra paycheck for retirement.

6. Home Improvements

Do you have a home improvement project you’ve been putting off? Using your extra paychecks would be a great time to knock the projects off your to-do list without tapping into your savings account.

7. Start a Vacation Fund

If it’s been a while since you took a vacation, you could use this extra paycheck to start a vacation fund. Whether you want to take a week-long family vacation or a weekend getaway with your spouse, this can help make it happen without stretching your budget too far.

8. Save for Christmas Present

Christmas can be an expensive time for a lot of families. To help ease the stress on your budget, you could put away your extra paychecks into a savings account to be used on Christmas presents.

9. Invest in a Tangible Asset or Collectable

While many people invest their money in traditional investments like stocks or mutual funds, you could diversify to other assets.

“Consider investing in tangible assets or collectibles that interest you,” says Fernandes. “These can include rare coins, vintage watches, or artwork. Tangible assets not only have the potential for appreciation but can also bring enjoyment and personal satisfaction.”

The Bottom Line

If you’re lucky enough to receive a couple of extra paychecks each year, devise a plan to put these to work for you. This could be to pay down any lingering debt, boost your retirement account, or go on a much-needed vacation without breaking the bank.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Experts: 9 Best Ways To Invest the Extra Money During Three-Paycheck Months