How Frequently Should Your Business Run Payroll?There are four payroll schedules, each of which has advantages and disadvantages.Costs and considerations affecting your payroll may include provider fees, cash flow, administrative costs and more.Misclassification, miscalculating overtime and late payments can complicate your payroll operations.This article is for business owners looking to determine how often they should run payroll.

Businesses have a lot of options when it comes to how often they pay their employees. Whether it is every week, every two weeks or once a month, there are a lot of factors business owners must consider when deciding how often to run payroll. Company size, legal requirements, payroll budget, whether employees are salaried or hourly are just some of the key considerations.

What is payroll frequency?

Payroll frequency how often you pay your employees. It is the amount of time separating paydays. For example, if you pay an employee every other week, that employee’s payroll frequency is biweekly. There are several different options businesses have to choose from, each with its own pros and cons. There are several factors businesses have to consider when choosing how often to process payroll, including payroll costs, cash flow and employee happiness. [Did you know that we’ve researched all of the top online payroll services for your small business?]

Payroll frequency refers to how often you pay employees each month.

Payroll schedules

There are four different payroll frequencies you can choose from.

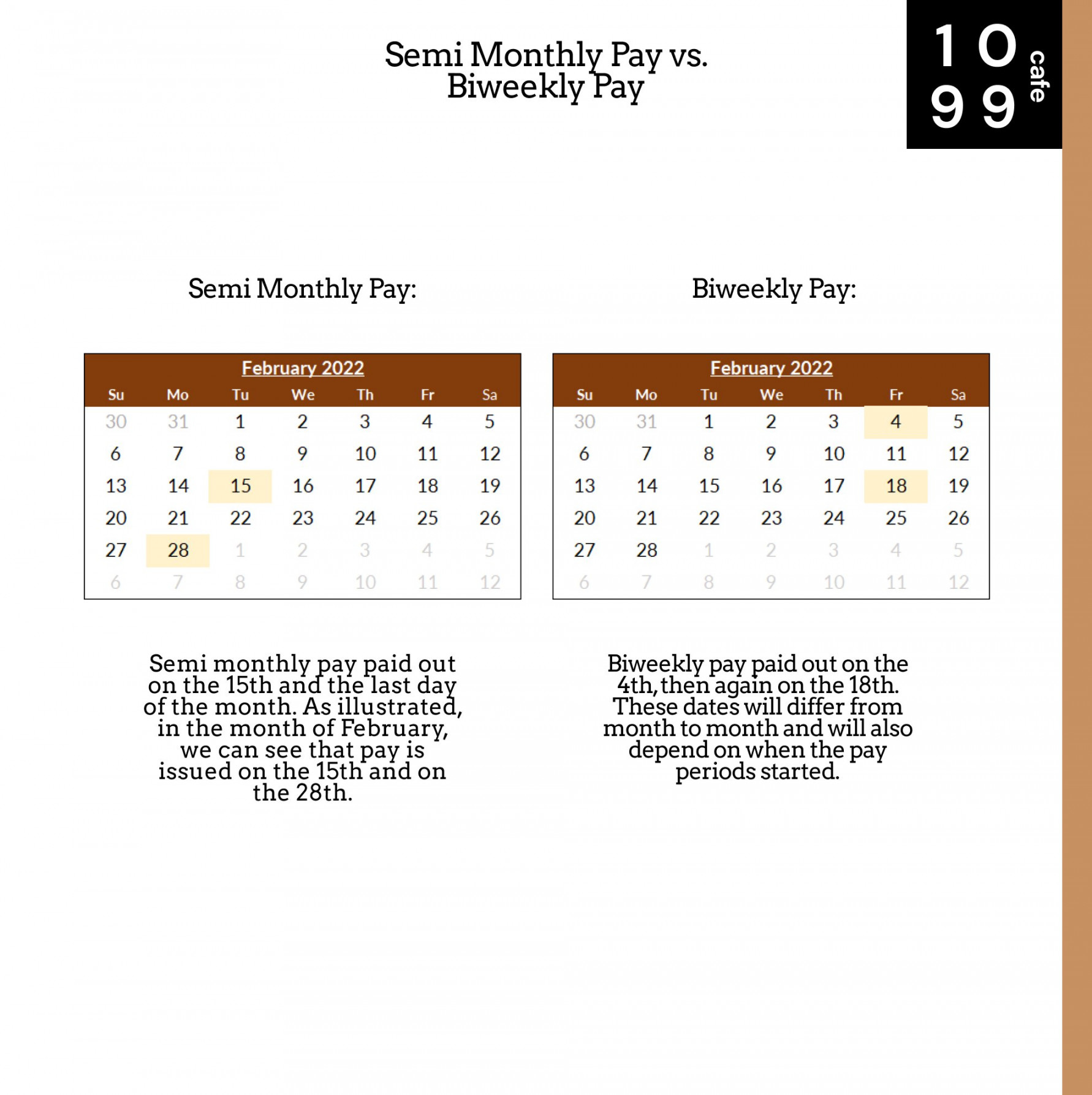

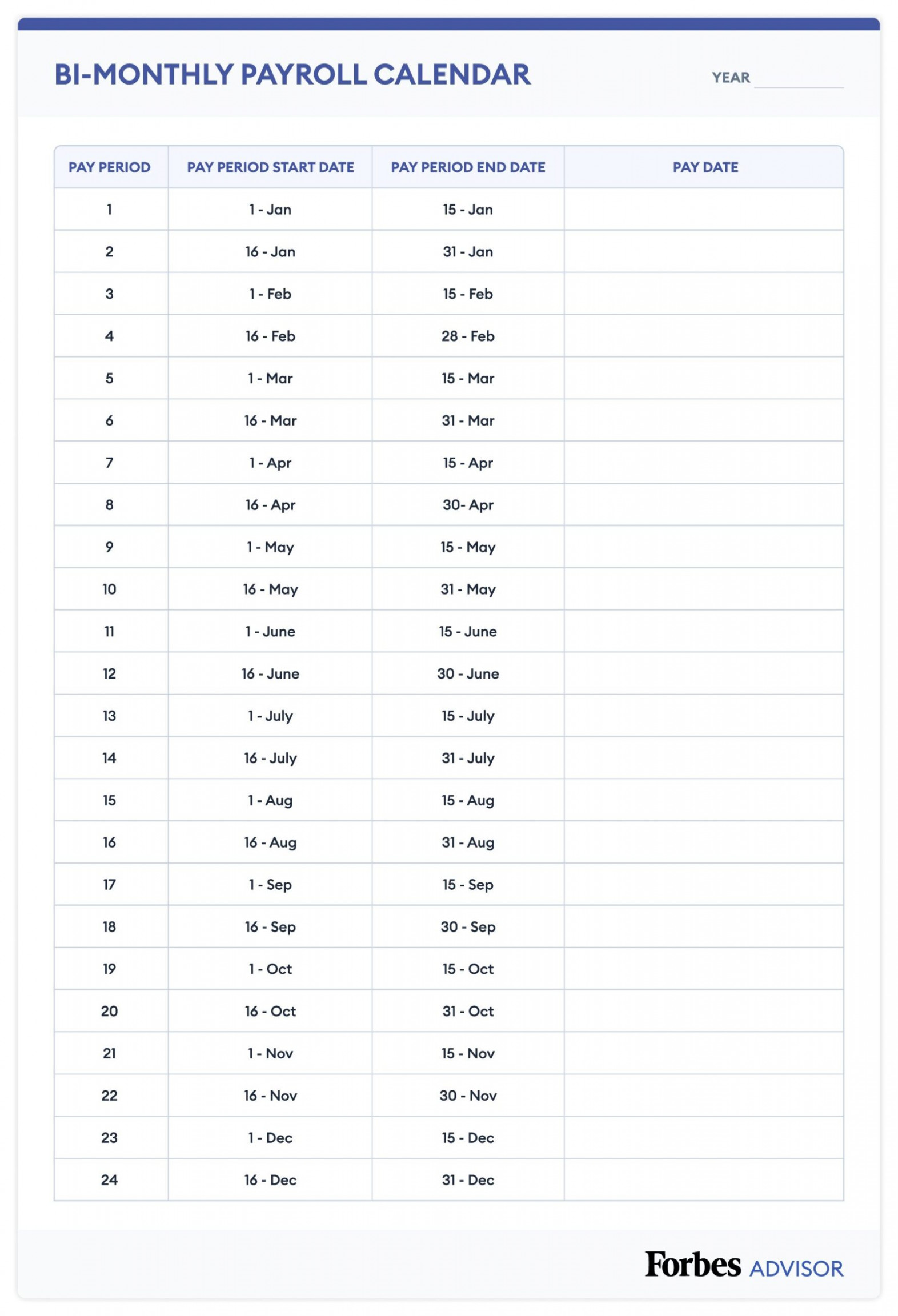

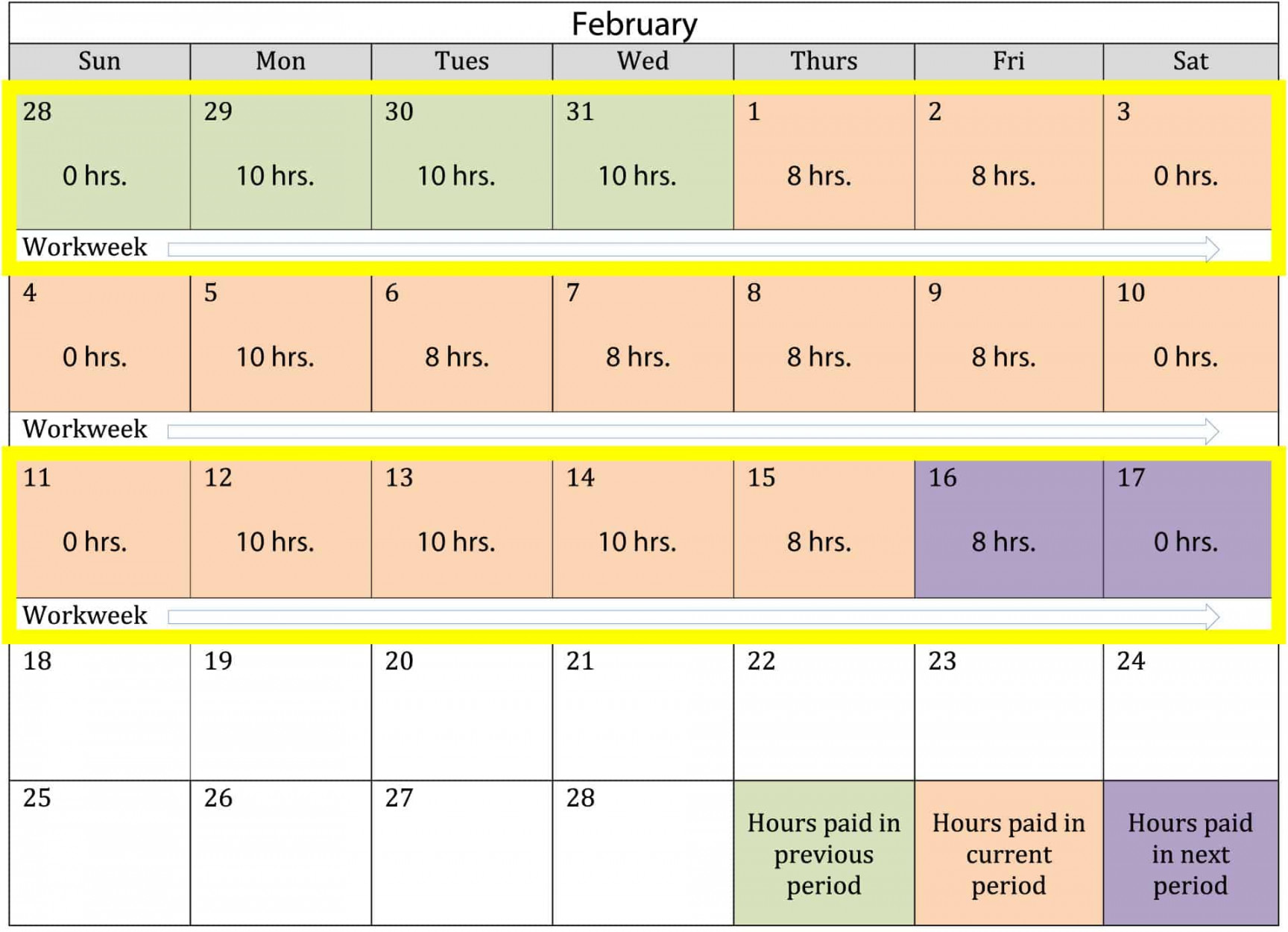

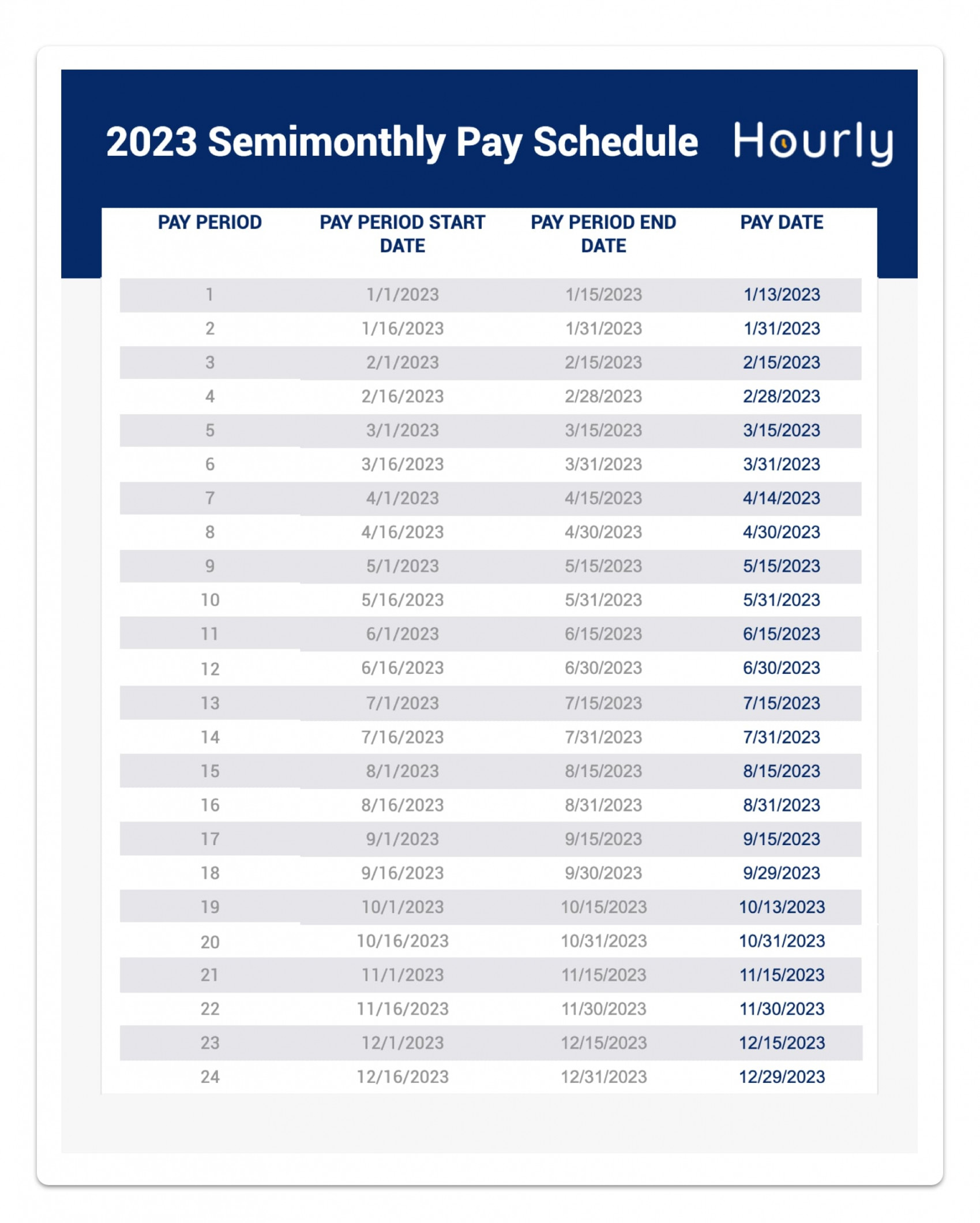

Weekly: Payroll is paid every week. This is typically the most expensive payroll frequency for a few reasons. For starters, paying employees more frequently often means spending more money, as many payroll services charge you each time you run payroll. That said, it is common for hourly workers to be paid weekly, and weekly pay means quicker wage access that can keep employees happier.Biweekly: Employees are paid every two weeks, typically on a Friday. It is the second most expensive payroll schedule for the same payroll processing fee and time loss reasons as weekly pay. Additionally, in some years, a biweekly pay schedule can lead to an extra pay period and thereby employee overpayments. Both hourly and salaried employees are often paid biweekly – in fact, this payroll frequency is the most common and may thus meet most employee pay expectations. Semimonthly/Bimonthly: This payroll schedule is often confused with biweekly; however, employees are paid twice monthly, typically on the 1st and 15th or the 15th and 30th. Its costs are similar to those of biweekly pay but not quite the same, as a bimonthly payroll frequency results in two fewer paydays per year and thus slightly lower annual payroll processing costs. Bimonthly pay frequency is often used for salaried employees, whose wages may be high enough that having their wages split across two fewer paychecks will not drastically affect their financial planning. Monthly: Employees are paid at the end of each month. While this is the least preferred payment schedule for workers, since it makes their financial planning more challenging, for employers, it’s the least expensive option. However, monthly pay may not pose as many financial planning obstacles for salaried (never hourly) employees whose wages are especially high.

Whether you choose to pay employees with a paycard or direct deposit, you still have to first decide which is the best pay schedule for your organization. Once that is determined, you can decide the best payment options.

Editor’s note: Looking for a payroll service for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

Salaried vs. hourly employees

According to Steffi Wu, a spokesperson for online payroll provider Gusto, the type of worker your business employs – salaried vs. hourly – also significantly impacts your payroll schedule. “Companies that mostly employ hourly employees typically run payroll more frequently, for example,” Wu told Business News Daily.

Laurent Sellier, vice president and business leader of QuickBooks Payroll, said salaried employees who receive a set amount each period are best off being paid semimonthly.

Whether you have predominately hourly or salaried employees could impact how often you run payroll.

Payroll schedules for small vs. large businesses

Sellier added that a business’s payroll schedule also depends on the overall size of the company. Smaller businesses that employ fewer workers may be able to get away with a more frequent payroll schedule. However, as your business grows, your needs may change.

“As companies grow larger and take on more headcount, a biweekly payroll schedule is typically the preferred schedule for a number of reasons, including cost savings, and it simplifies reconciliation,” said Sellier.

Payroll frequency may become less of a decision for organizations as more and companies are now offering on-demand payroll, which allows each employee to choose when they want to be paid.

Legal requirements

There are both federal and state requirements small business owners must follow when deciding how often to pay employees. These laws establish other important payroll requirements, such as minimum wage rates and overtime. The Fair Labor Standards Act, said Sellier, does not dictate how often a business can pay employees, as long as employers pay employees for the hours they have worked. However, he noted that individual state laws may vary.

“Most states set either a weekly, biweekly, or semimonthly payday schedule,” said Sellier. “For example, states like Nebraska and Pennsylvania allow the employer to designate paydays. Arizona, [however], requires employers to pay employees twice a month but 16 days apart.”

Federal and state payroll laws govern payroll concerns such as overtime, minimum wage and payroll frequency, and each state has its own unique set of regulations.

The cost of running payroll

According to Wu, cost-associated factors, like business cash flow and available debit schedules, typically guide payroll schedules. Since there is no one-size-fits-all approach for processing payroll, your costs will vary based on a number of factors, such as tax requirements, the number of employees, service bundles and, sometimes, your current payroll frequency.

The costs of running payroll exceed the fee the payroll company will charge you. Keep in mind there are additional administrative costs you’ll be responsible for. Add-on fees you’ll incur each time you run payroll may include, among others, printing paper checks, data entry and direct deposit charges.

Payroll costs and considerations include payroll provider fees, administrative costs, cash flow and more.

Complications

As a small business owner, there are some risks you face processing payroll yourself or having an employee process payroll for your business. The three biggest pitfalls include:

Misclassification: According to Sellier, employers sometimes misclassify the type of worker they are running payroll for. For example, you might pay someone as a contractor when the law says they should be paid as an employee. As the employer, it is your responsibility to review employee classifications and ensure you are accurate and compliant in classifying and paying employees.Miscalculating overtime: Managing overtime can be a challenge for many employers, said Sellier. This includes either not paying overtime or paying it incorrectly. To avoid miscalculating overtime payments, properly monitor employee hours and the overtime pay rate. Late payment: Completing payroll on time is a common complication and can be especially difficult for small businesses. This can be avoided by outsourcing your payroll.

According to Wu, many complications can be mitigated by using a payroll system that does the tricky work for you. This includes choosing a payroll system that can automate your payroll and file and pay taxes for you.

Finally, when determining how often your business should run payroll, keep in mind that you can pay salary and hourly employees at a different rate, and this might be necessary, depending on your business.

Most payroll companies give you the option to update or change your payroll schedule, so if you decide your current schedule isn’t the best option for your business, you are free to make the switch.

The three most prominent complications of administering payroll are misclassification, miscalculating overtime and late payments.

Additional reporting by Max Freedman.